Unfortunately that’s not an simple question and the answer depends

almost entirely upon your situation & where the property is located.

Yes, where the property is located can open or shut some mortgage loan type doors.

So let’s do a simple comparison exercise.

To simplify things I’m going to say there are 2 basic

loan classifications you’ll need to choose between:

-

1)loans where the payment changes every so often &

-

2)loans where the payment stays the same for the life of the loan.

There’s a time and a place for both of those loan types & an argument can be made that either could be the best loan for you under certain circumstances, but since almost everyone wants a fixed rate payment, all of my examples will be based upon a 30 year Fixed Rate mortgage. Just realize that the comparisons I’m about to give you will work for all loan types.

Next you have to decide which loan type is best for you,

FHA - VA - USDA or CONVENTIONAL?

FHA allows the lowest credit scores and slightly higer Debt to Income ratios,

but their payments are the highest of the loan types.

VA is only for Veterans who have served a certain amount of time.

It’s not for spouses & not for children.

USDA is for more suburban or rural properties & has income & property

location limitations, but has the cheapest payment.

Conventional has payments lower than FHA, but doesn’t allow as

low of a credit score but we can go almost as high of a DTI ratio as FHA.

Choosing the loan type is the toughest choice since each one of these types has their own eligibility criteria, down payment requirements, minimum credit scores, etc. so you’ll need to see which type fits your set of circumstances. (Call us and we can tell you which loan type is best for your situation.)

But I don’t want to overly complicate things - yet - so what we will be looking for here is to determine which loan type has the lowest payment for the same type of loan.

Well obviously it must the one that has the lowest rate, right?

WRONG!

People think the loan type with the lowest interest rate will give them the lowest payment, but rate & payment don’t always go hand in hand because there are other factors at play here.

Your monthly payment consists of 4 things - PITI

Principal

Interest

Taxes

Insurance(S)

Your Taxes & Homeowners Insurance do not change based upon loan type so

they don’t affect which loan is best for you.

Taxes & Insurance are a factor of the value of your house & where it is located. They don’t change depending upon the loan type, so for now we are going to ignore them because they’ll cost the same regardless of what loan type you have. Just keep in mind that you’ll still need to add your taxes & insurance to your Principle & Interest payments to get the full PITI.

You’ll notice up above that I said Insurance(S). That’s right there’s another insurance other than Homeowners Insurance you have to worry about. It’s commonly called Mortgage Insurance (MI). FHA - VA - USDA & CONVENTIONAL loans all have some form of it even though it’s not always called MI.

What is Mortgage Insurance (MI)?

MI is what allows you to put down less than 20%.

MI is an insurance policy that reduces the exposure or risk of the loan holder to 80% or less, if you should default on your loan.

In other words you pay for a mortgage insurance policy instead of having to come up with a 20% downpayment. (BTW if you have credit scores of 640 or higher we can offer you a 15-25% discount on Conventional MI rates. Other lenders can’t)

As you might have guessed by now, to compare loan types you must look at the Principal, Interest & MI payment.

Enough talk! Now let me give you some simple math that will

make it easy to see the cost/payment differences between loan types!

Don’t worry, this math is simple enough to do on your fingers & toes or a smartphone calculator. Your brain will definitely NOT explode!

A quick way to compare loan types is to add the cost of the Mortgage Insurance to the interest rate and see which total is lowest and then see which one has the lowest upfront MI cost. Not all loan types have an upfront MI cost.

1) For instance a loan with an interest rate of 4% and a MI cost of .5% per month and no up front MI would give you an effective interest rate of 4.5%.

-

2) Whereas a loan with an interest rate of 3.5% and a monthly MI cost of .85% and 1.75% upfront MI could give you an effective interest rate of 4.35% PLUS the 1.75% up front fee (which is usually added into your loan and makes your payment higher).

This would make mean #1 the 4% option would be your best choice by a small margin. But it would have appeared to be the more costly option if, like most people, all you shopped was rate.

Also keep in mind that by rolling the upfront MI into the loan you will be paying interest on your MI for as long as you have that loan which greatly magnifies this cost. So the longer you lived in the property the worst Option #2 would have been for you.

Now you need to look at the loan to see if the MI will ever disappear or will it last for the life of the loan.

If the MI drops off later that can drop your monthly payment by $100 - $200 or more!

So let’s compare Mortgage Insurance costs as of March, 2018.

FHA = 1.75% Upfront .85% yearly - for the life of the loan!

USDA = 1.00% upfront financed in loan and .35% monthly - for the life of the loan!

VA is more complicated because the MI (Funding Fee) varies by downpayment, whether it’s the first time you’ve used your VA entitlement and whether you were Active duty or National Guard or Reservist.

VA does NOT have a monthly mortgage insurance cost. They only have an upfront fee that can be rolled into your loan amount.

FIRST TIME USE OF BENEFITS Active duty National Guard or Reservist

0% down payment 2.15% 2.40%

5% down payment 1.50% 1.75%

10% down payment 1.25% 1.50%

SUBSEQUENT USE OF BENEFITS Active duty National Guard or Reservist

0% down payment 3.30% 3.30%

5% down payment 1.50% 1.75%

10% down payment 1.25% 1.50%

CONVENTIONAL loans offer all the MI options of all the other mortgage types, except it is usually much cheaper AND they have the added benefit that their MI drops off at a specified time, thereby dropping your monthly payment significantly.

With a Conventional loan YOU DON’T HAVE MI if you put 20% down.

If you don’t have 20% to put down then once you either pay the loan down to 80% of the original value, OR once your home value increases so that your present loan balance is 80% of it’s present (increased) value THEN MI is dropped off and you no longer have to pay it.

Conventional MI costs vary by your downpayment. The more you put down the less expensive it is. Because Conventional loans base their MI costs on Loan To Value (LTV) and have different tiers of costs for each level (95%-90%-85%). This allows you to “work” the system and get an even lower rate. In many cases you could put .1% more down payment ($100 per $100,000 of loan) which will buy you the next lower rate costs which can save you lots of money.

Since it’s so much cheaper why doesn’t everyone use a Conventional loan?

-

•Not everyone has credit scores above 620. (we can do FHA loans down to a 530 score, VA down to a 560 score, and USDA down to a 581 score)

-

•Not everyone has enough money for a down payment. (VA & USDA loans don’t require a downpayment. Conventional loans require a 3% down payment and FHA requires a 3.5% down payment.)

-

•Other loan types are more liberal about allowing down payment gifts from family members.

-

•You might not be able to qualify for as large a loan because Conventional loans aren’t as liberal with debt to income ratios.

In a minimum down payment situation, after 5 years you will have paid about 4X the amount of MI on an FHA loan than a Conventional loan. If you put more than minimum down on the Conventional loan the comparison becomes much worse for FHA.

So this means you never want to do an FHA loan? NO, that’s not right! There is no ONE loan that is right for everyone. Sometimes due to your credit scores or other situations FHA is the right loan for you. Not everybody qualifies for all loan types so you have to look at the loan options available to you and then find the loan that costs you the least. Since the Recession there are no BAD mortgages available to Consumers, it’s just that some loans are cheaper than others.

But when you look at all aspects, instead of just the interest rate, it means that if you have the option you might be better off to pay slightly more each month now to get a loan that will allow you to drop your MI off later.

(This is the point that you people who aren’t Math Nerds might have your brain explode) With Conventional loans there are a couple of MI options I left out of the comparison. You can choose to pay part of your upfront MI upfront and pay the other part monthly. This is not to be confused with a loan that has upfront MI AND monthly MI payments.

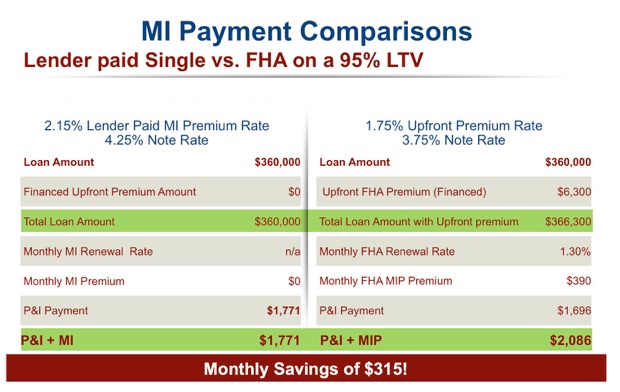

And then there is Lender paid MI which many Lenders advertise as a No MI loan because it looks like you don’t have MI, but you really do.

It’s just hidden in a slightly higher interest rate or higher closing costs.

Another thing to consider when deciding which loan type

is the best for your situation are the loan limits.

You need a loan that can do a loan of the size you’ll need. All across the board the new Dodd-Frank Act laws pretty much make it impossible for a lender to do a mortgage smaller than about $42,000-$45,000 and to be safe, many lenders won’t make a loan smaller than $60,000. But the upper limits vary by loan type and area.

For the DFW area:

Conventional loans allow Conforming loan amounts of up to $453,100.

(our Conforming can go up to $679,650)

Jumbo loan limits of $4,000,000

FHA allows loan amounts of up to $334,650 (it’s only $271,050 outside the metroplex area)

VA allows loans of up to $750,000

USDA loan are limited by county and personal situation, but we’ve done USDA loans of up to $400,000+

Thoroughly confused? Just call us and we’ll be happy to answer all your questions and help you figure out what is the best program for you.

PAYMENT IS EVERYTHING!

A lower payment means your house will be less costly to own.

It also means you can qualify for a larger home &/or have fewer difficulties securing a mortgage since loan applicants are qualified based upon the monthly payment.

This might even help you work around any weaknesses that might be inherent in your situation. (don’t worry, everyone has a weakness)

Here are some implications &/or consequences

that aren’t readily apparent on the surface.

I’ve given you a couple of examples stolen from I mean taken from one of the MI companies. These can show you some ways to use MI to your advantage. The first example shows you how you can buy a house for $313,000 and have the same payment as a house costing $258,000 simply by changing loan type and MI type.

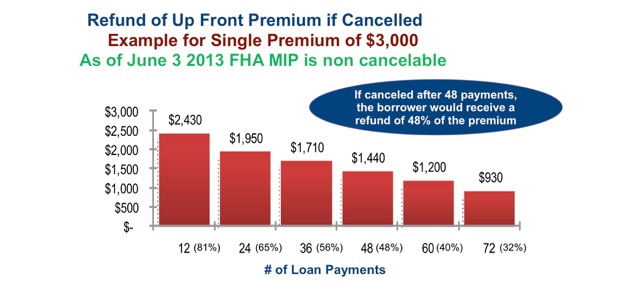

BUT WHAT IF I PAY ALL MY MI UPFRONT (SINGLE PAID) AND I DON’T LIVE THERE 30 YEARS?

Then you get a refund of the unused portion.

Here’s an example to show you how Lender Paid MI works.

BTW if you don’t want to pay MI then you’ll need to use a Conventional Mortgage and put down at least 20%. All other loan types require MI regardless of loan amount or how much you put down.

FINANCIER$ offers all program types, and even a few options not listed above. Call us and we can talk about your particular situation.